Tailored Financial Solutions, Backed by Experience.

At Moneyverss, we believe that finance shouldn’t be a maze—it should be a bridge to your dreams. Born from a passion for simplifying the complex world of finance, our mission is to empower in......

Read MoreEvery number tells a story — of trust, growth, and lives changed.

Finance made simple. Advice made personal. Results made real.

We're partnered with 50+ top banks & NBFCs to get you the best-fit options, faster.

One core team brings 40+ years of experience in financial consulting - so you're in safe hands.

We simplify finance so you can make confident decisions without confusion.

Your goals and challenges come first. We offer solutions that truly fit your needs.

Loans, Funding, Subsidies, Or Financial Health Checkups - We Handle it all.

From first query to final approval - We walk with you at every step.

Celebrating achievements that inspire excellence.

We're Honored By the feedback, and it fuels our commitment to delivering exceptional financial services.

Read the reviews to hear firsthand how fairstone is making a positive impact on people's lives,

Your trust is our greatest achievement.

Empowering You with Knowledge for Smarter Financial Decisions.

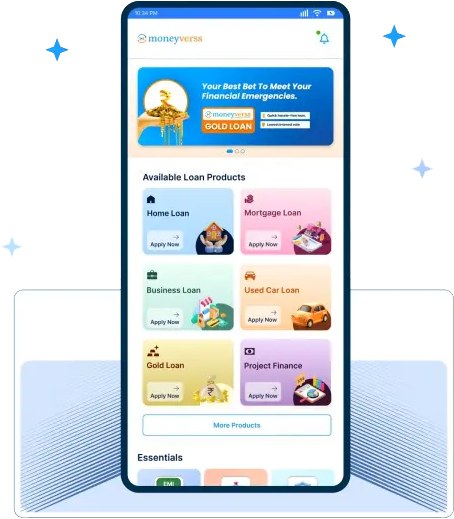

Take advantage of our convenient mobile apps to access our services anytime, anywhere. Download our apps today and experience the ease of managing your finances

Quick Loan Application

Quick Loan Application

Secure and Private

Secure and Private

User-Friendly Interface

User-Friendly Interface

Stay Connected

Stay Connected

Because great outcomes begin with strong partnerships.